Putting a Face on Your Quantitative Research With Qualitative

Posted on January 10, 2019

When done well, qualitative research can put a face on your quantitative research. It can tell you who your customers are as people. What makes them tick? What they experience. What their lifestyle is like. What their values, needs and motivations are. It can clarify communications, how your product or brand fits into their lives, or shed light on what new features or enhancements matter to them.

In short, qualitative explains the why behind otherwise one-dimensional data. Furthermore, a holistic understanding of their customer gives organizations the confidence they need to make (often quick) decisions on an on-going basis. When teams become engaged with their customers the outcome is often better performance and profits.

One of the classic ways to use qualitative to help bring research to life is by developing personas for customer segments. Most segmentation studies are complex, high profile, and expensive. To be effective, the segments must be “measurable, substantial, accessible, differential, and actionable.” And “homogeneous within” but “heterogeneous between.” What? It’s no surprise that to many folks outside the consumer insights team, the segments often feel like statistical figments of the imagination. Who are these people? Do they really exist?

Building qualitative personas for customer segments can really change the way organizations think about their customers and, as a result, how they act. It can align teams around a shared understanding of their customers by removing complexity and focusing on people and service.

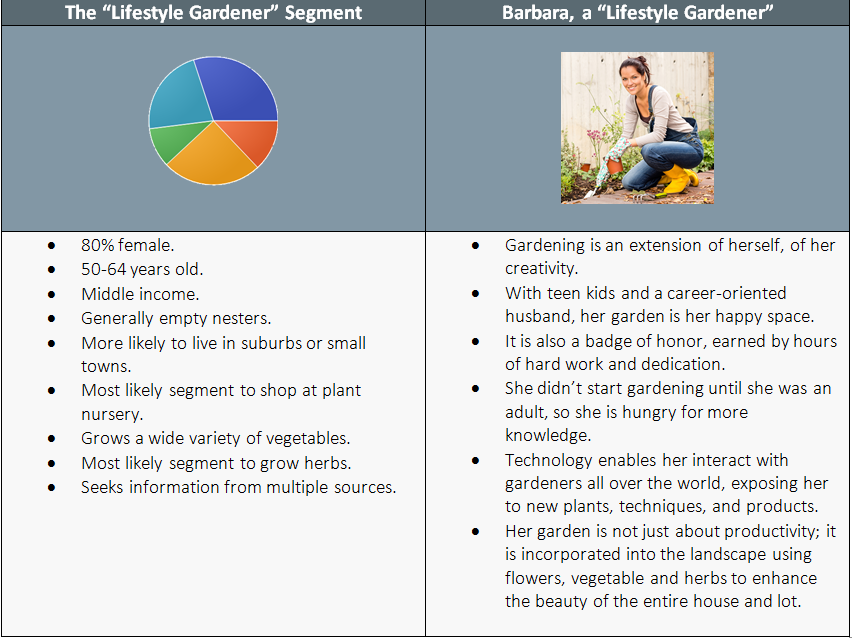

For example, we recently helped a plant and gardening brand get to know the humans behind their segmentation. Their customer segmentation study had revealed three major “core” segments, and five “emerging” segments that showed the most promise for growth and development. Our qualitative research helped the team understand the five new segments by creating composite personas that highlighted the differentiating attitudinal and behavioral attributes of each segment.

When it came to discovering the human side of our quantitative “lifestyle gardener,” there were at least three essential herbs and spices to cooking up great qualitative approach.For organizations, it is much easier to see (and understand) Barbara, our collective “persona.” While she began with the basic characteristics from her statistical segment, she became human: given a name, face, personality, family life, etc. to paint a picture of what she would want and need, and why, in real life. Now that we get her – her emotions and needs- we understand how to meet her needs, and what types of communications and messaging will resonate.

- Building Rapport. Sometimes you just “hit it off” with someone, but in qualitative research making people comfortable is a true skill. If you want to have an open, honest conversation, you have to be able to build rapport. Breaking the ice and a good sense of humor helps. You can further build rapport by actively listening, not judging, being sensitive, observing and understanding non-verbal cues, being truly interested in what people have to say, and appreciating them as people. All of this leads to getting better qualitative responses and richer information.

- Training & experience. Being a “natural” is great, but learning how to control a ‘dominator’ in a focus group or draw out an introverted interviewee takes training and experience. Great qualitative researchers are flexible and creative, hone their skills, and have a tool belt full of techniques to uncover the underlying values and emotions behind the rational responses.

- Understanding the business goal. How the qualitative research fits in to the team’s needs and goals is paramount. A basic understanding of the business helps with probing areas for more in-depth discussion, adapting or pivoting when necessary, and demonstrating a degree of “sophisticated naïveté” with the participants.

Learn more about how Marketry can help bring out the human side of your customers with qualitative research.